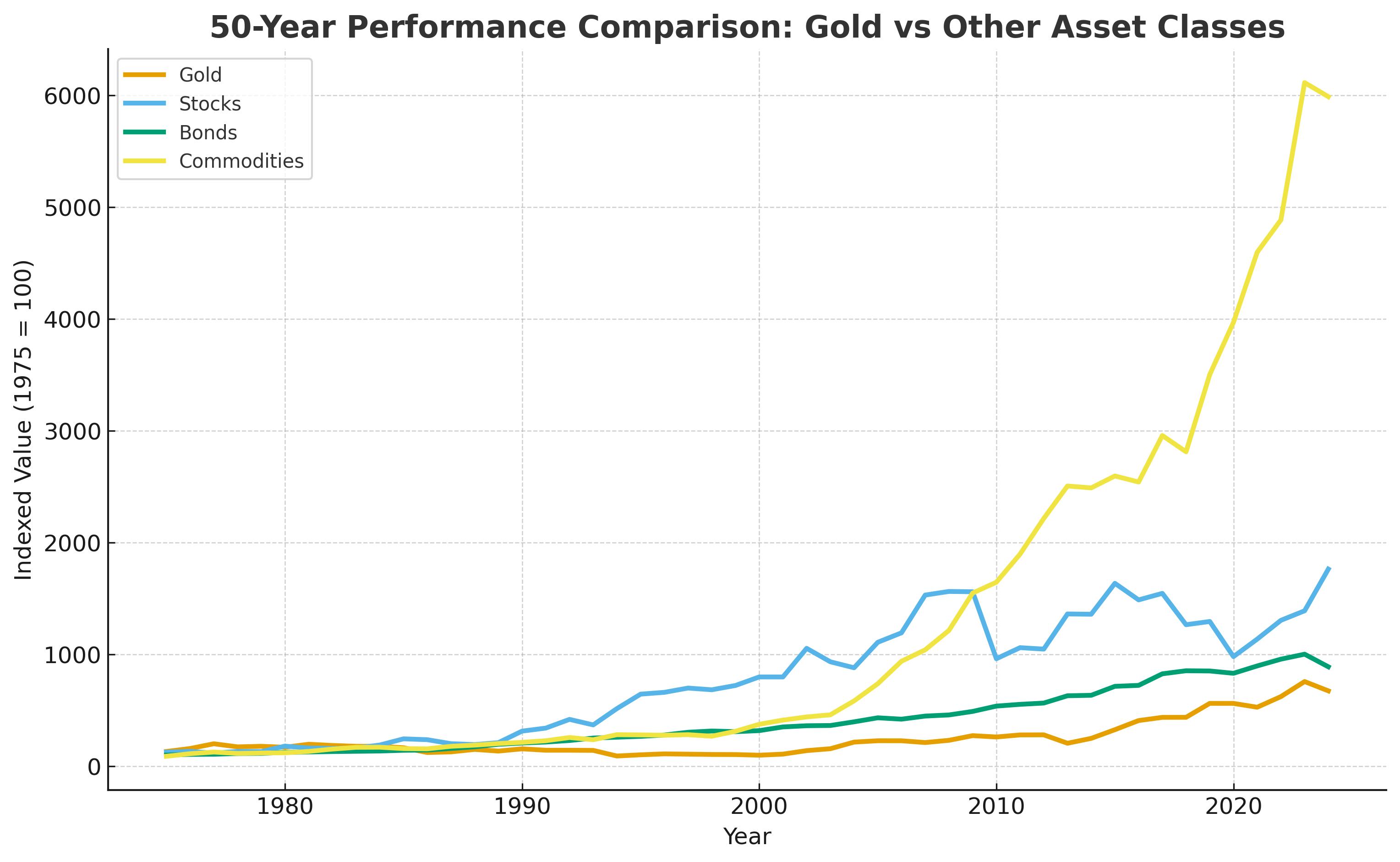

Why Traditional 60/40 Portfolios Need Reassessment

Market dynamics have shifted. Drawing on a 50-year analysis (1973-2024), our research indicates gold isn't just a crisis hedge. The data shows it has delivered long-term stability and improved risk-adjusted returns—even in "normal" economic environments.

Download Report