The rules for growth and diversification have changed

How does a great portfolio address today’s market challenges? By managing risk first.

Learn how to build portfolios that incorporate the risk management and diversification needed to help protect clients from big losses. Don’t forget to download your free resources!

2-Part Series

How to build a modern investment portfolio

Learn how to build portfolios that incorporate the risk management and diversification needed to help protect clients from big losses. Don’t forget to download your free resources!

PART 1 ENCORE

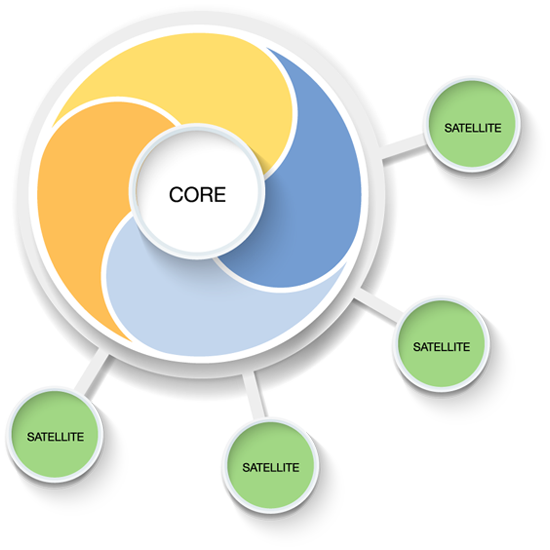

Part 1 presents a modern approach to portfolio design that goes beyond basic asset allocation to incorporate multiple levels of risk management, responsiveness to market changes, and strategic diversification. You will also learn how to make the most of your portfolio’s core and use tactical, alternative, and specialty strategies to boost portfolio performance and provide another measure of risk protection.

PART 2 ENCORE

Part 2 shows you how to use our suite of adviser tools to evaluate the effectiveness of your portfolio by “crash testing” strategies to see how they perform in different market environments, analyze the correlation of your strategies to see if your portfolio is truly diversified, and examine how your portfolio can perform in a way that goes beyond the sum of its parts.

Resources

Reinforce the lessons you learned in the webinar series and get on the path to building portfolios that better serve your clients’ needs.

“The Rules for Growth and Diversification Have Changed” e-book

Discover what Flexible Plan Investments president Jerry Wagner sees as shortcomings in the financial industry’s “traditional” investment approach—and how he defines today’s best practices in modern portfolio construction.

Evolution of risk management

Learn the daunting market math that makes managing risk a necessity and how the evolution of risk management has influenced our philosophy on building portfolios.

Different approaches to building a modern portfolio

Analyze the pros and cons of the different methods of building a modern, risk-managed portfolio.

Categories of risk-managed strategies

Find out how our nine categories of risk-managed strategies fit within a modern portfolio.

“Building a Portfolio” worksheet

Practice building dynamically risk-managed, strategically diversified portfolios based on the guidelines presented in our webinar series.

"Building a Portfolio with Low Fee Strategies" worksheet

Practice building dynamically risk-managed, strategically diversified portfolios based on the guidelines presented in our webinar series.

|

|

DISCLOSURE — Flexible Plan Investments, Ltd. is a federally registered investment adviser. This is provided for information purposes only and should not be used or construed as an indicator of future performance, an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. Flexible Plan Investments, Ltd. cannot guarantee the suitability or potential value of any particular investment. Read Flexible Plan Investments’ Brochure Form ADV Part 2A carefully before investing. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. Inherent in any investment is the potential for loss as well as profit. A list of all recommendations made within the immediately preceding twelve months is available upon written request.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. Inherent in any investment is the potential for loss as well as profit. A list of all recommendations made within the immediately preceding twelve months is available upon written request. Please read Flexible Plan Investments’ Brochure Form ADV Part 2A carefully before investing.